trust capital gains tax rate 2022

For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. It continues to be important to obtain date of.

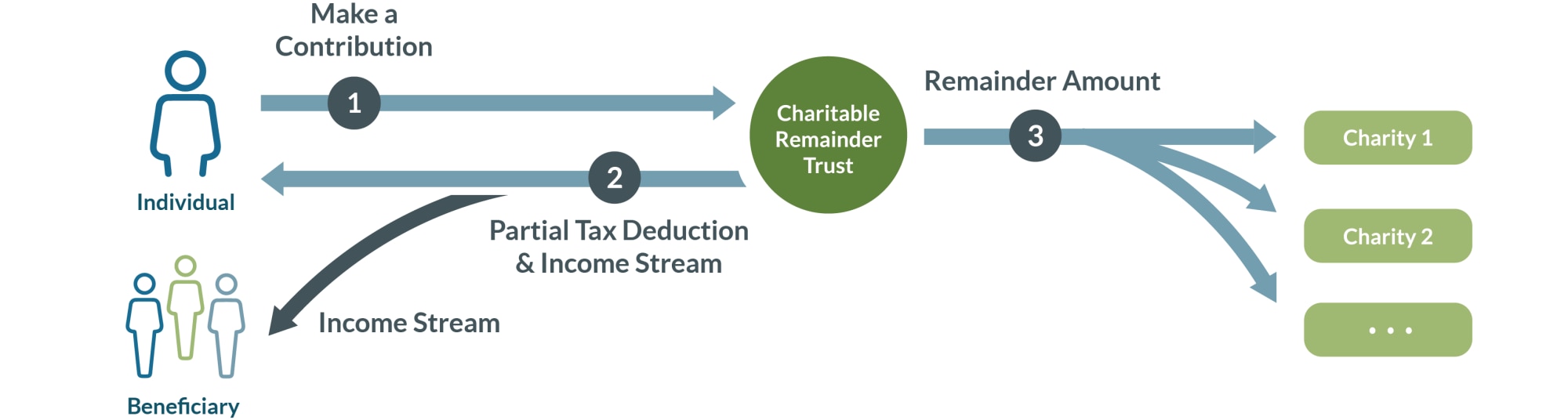

Charitable Remainder Trusts Fidelity Charitable

2021 capital gains tax calculator.

. If a vulnerable beneficiary claim is made the trustees are taxed on the. 2021 to 2022 2020 to 2021 2019 to 2020. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. Small business exclusion of capital gains for individuals at least 55 years of age of R18 million when a small business with a market value not exceeding R10 million is.

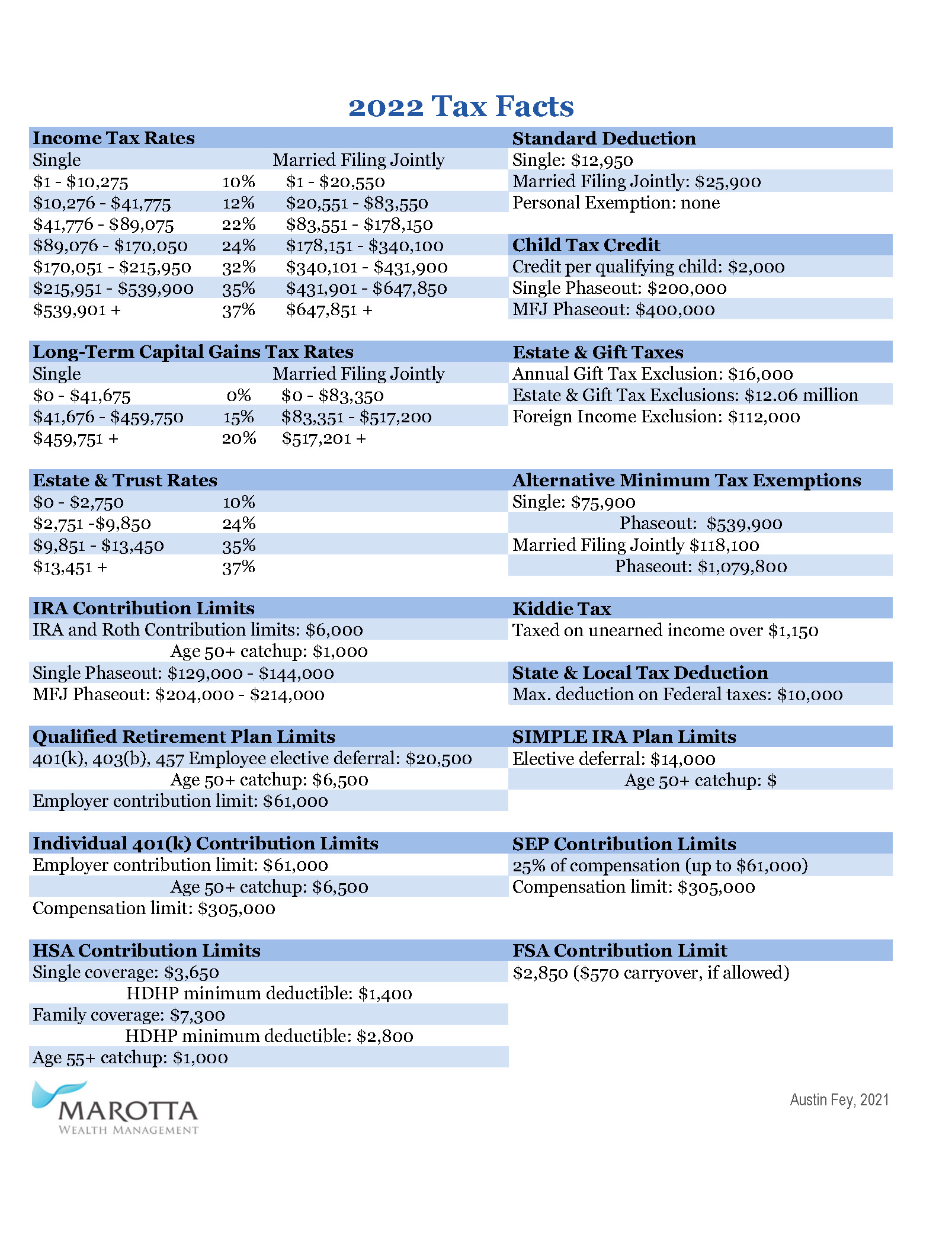

The following Capital Gains Tax rates apply. March 16 2022 2022 FIDUCIARY INCOME TAX Updated Rates and Brackets Below is some commonly relevant federal income tax information for estates and trusts. 2022 capital gains tax rates.

The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and whether the asset was a short-term or long-term investment. Maximum effective rate of tax. What is the capital gains tax rate for trusts in 2022.

Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital. The maximum tax rate for long-term capital gains and qualified dividends is 20. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

Or Trustor when a. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. For tax year 2022 the 20 rate applies to amounts above 13700.

The maximum tax rate for long-term capital gains and qualified dividends is 20. The 2022 estimated tax. 1 week ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. HS294 Trusts and Capital Gains Tax 2020.

The tax rate applied to 2023 short-term capital. 1 week ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. 1 day agoThe IRS has already released the 2023 thresholds see table below so you can start planning for 2023 capital asset sales now.

20 for trustees or for personal representatives of someone who. Find out more about Capital Gains Tax and trusts. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

It continues to be. The tax-free allowance for trusts is. Those tax rates for.

6 days ago 1 week ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. It also deals with. It continues to be important.

It continues to be. By comparison a single investor pays 0 on capital gains if their taxable. Capital Gain Tax Rates.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. Individuals and special trusts 18 Companies 224 will. An overview of the capital gains tax treatment of UK resident trusts set.

Income Tax and Capital Gains Tax. 2022 Capital Gains Tax Capital gains on the disposal of assets are included in taxable income. For tax year 2019 the 20 rate applies to amounts above 12950.

Tax Advantages For Donor Advised Funds Nptrust

2022 Capital Gains Tax Rates Federal And State The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2022 State Business Tax Climate Index Tax Foundation

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Bland Garvey Cpa 2022 Capital Gains Rate Richardson Tx

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Real Estate Capital Gains Tax Rates In 2021 2022

Exiting Entrepreneurs Can Pay Less Tax Bernstein

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

2022 Key Planning Figures Fiduciary Trust

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

What Is The Highway Trust Fund And How Is It Financed Tax Policy Center

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)